Financial Services

ACC Dev-Ops team help adopt Enterprise DevOps for for Banking customers ensuring control and security are followed.

ACC HUB PAY is fully customizable solution which provides user portals, origination, servicing, and collections and can automate the entire lending lifecycle including underwriting, servicing and collections.

Cloud based Loan Origination Systems – Deployment Options

Facilitating AWS Cloud Adoption

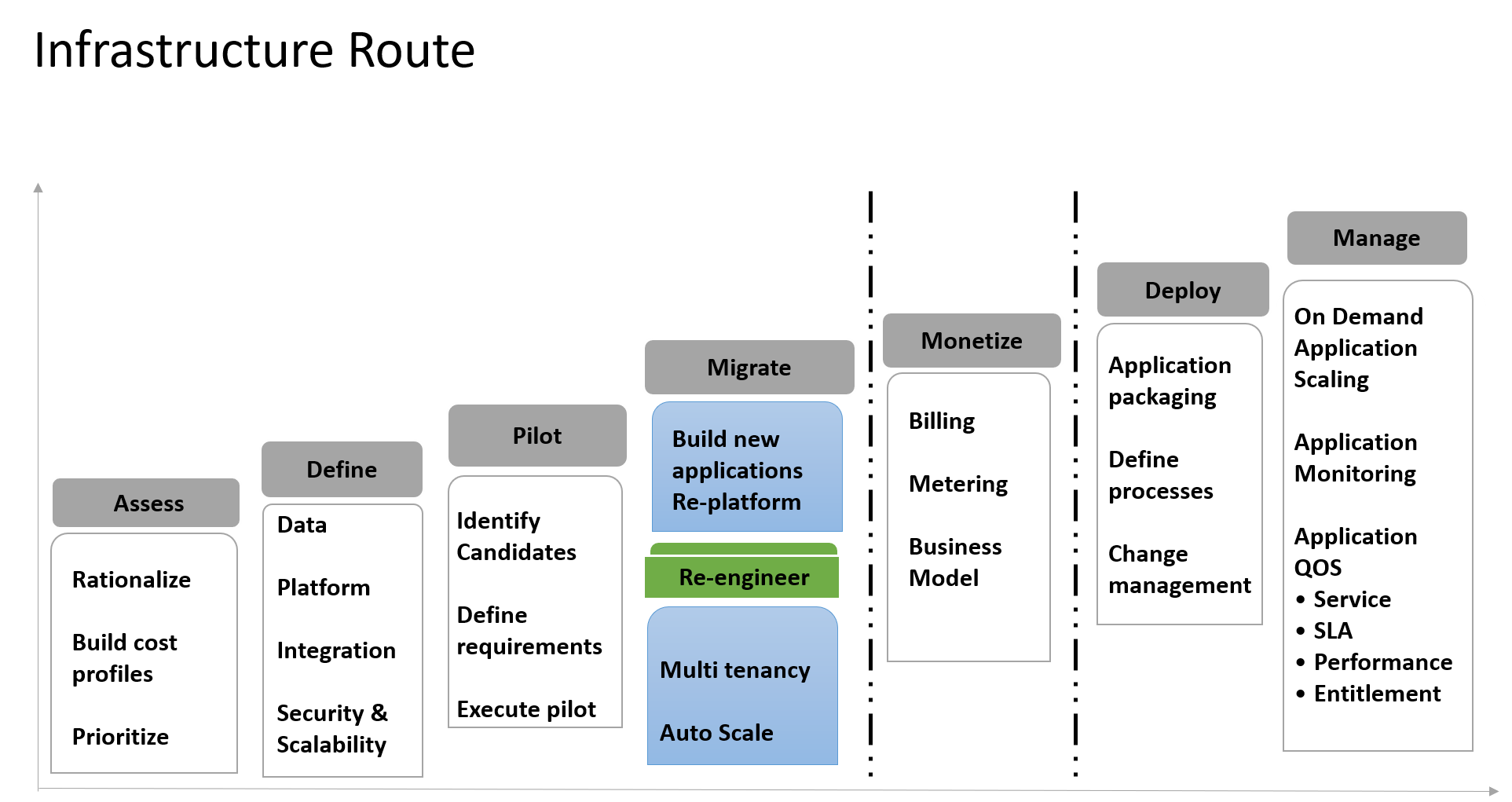

Infrastructure Route

Microservices Route

SAP Route

Analytics and Dev-Ops Route

Microservices Route

Power-SB accelerates innovations by enabling our clients to democratize the developments using advanced technologies and centralize Microservices management system. PowerSB is designed to increase the efficiency by 50% in cost, time and resources. Using the easy to understand user friendly web interfaces, developers can

- Submit Java / Nodejs standard language source code (.Net WIP)

- Map input data requirements from data source

- Define execution frequency

- Define dependencies

- And define which destination platforms needs to receive the output

- Assist building Glue-Code to integrate with legacy applications

- Governance workflow to ensure each microservice consumption as in adherence to Organizations’ compliance requirement

- Provision infrastructure on AWS to host Microservices

Power SB

AWS offerings & solutions

Consulting Services

Migration and Deployments

Managed Services

Cloud Native Application Devlopment

Case Study - Edelweiss General Insurance - SAP for Insurance

The Challenge

Edelweiss General Insurance Company, a wholly-owned subsidiary of the Edelweiss Group. Edelweiss’ general insurance business will be rolling out the 29th insurance company in the country with focus on DIGITAL insurance products to start with. And was extremely keen on implementing the SAP Insurance Core application on a tight timeline both for infrastructure and SAP customization

Why Amazon Web Services

The infrastructure runs on SAP-accredited Amazon Elastic Compute Cloud (Amazon EC2) instances with Elastic Load Balancing distributing data traffic. The company takes advantage of Amazon Elastic Block Store (Amazon EBS) for storage services and Amazon Simple Storage Service (Amazon S3) for backups. To help optimize the infrastructure. Also uses AWS Lambda, which automatically shuts down non-production systems during quiet periods to reduce costs.

The Benefits

By adopting SAP S/4HANA running on the AWS Cloud, EGI executives now have real-time data on EGI operations. Besides improved decision making, the SAP infrastructure on AWS is significantly more cost-effective than the on-premises data center.

Additionally, EGI has cut down on the amount of IT resources it needs for its SAP systems. The auto-scaling and failover capabilities available with AWS services save the IT team a lot of time because they are no longer responsible for so many routine administration tasks.

Case Study - Tata Capital - Loan Orgination and Mandate Management System

Traditional Process – Customers are on boarded by Sales team and loan was proposed and all details were updated manually. Customer requirement, KYC, Cibil generation, credit approval and Sanction letter were tracked in an excel and basis that information, customer details were handled internally and loan was disbursed to customers. All the customer related documents were handled manually and shared with customers.

New Process – Customers information was gathered and entered in the LOS where personal details and loan requirements (with co – applicant if required) are tracked. Every stage of the customer journey is tracked in the system so there won’t be loss of customer details. Customer details and every stage is tracked in LOS. Below are the steps considered in LOS:

1. Customer Requirements

2. KYC

3. Credit Approval

4. Cibil generation

5. Sanction letter

Customer details are entered in LOS and basis the entered details customer journey starts until loan is sanctioned and loan is at pre disbursal stage.

Learnings:

Applicant details for applying any loan were stored in excel but via LOS applicant or co applicant details, requirement for the loan and for every stage in loan origination can be conducted. Cibil report of customer and basis that can take decision whether to give loan to any customer.

In LOS ACC learned the process of onboarding customer and what all measures are considered while approving loan to any customer. IF all the check points are proper then customer will be eligible to apply for loan and sanctioned amount can be disbursed.

Mandate Management System (MMS)

Traditional Process – The mandates which are signed by users post approval of the loan were handled and managed manually from registration to debit transaction as per the cycle of the customer loan journey. The mandate details from various Loan Management System (LMS) are received and by collating all customer lists are shared to aggregators. The steps manually handled by users were:

a. Mandate Registration – Mandate forms signed from customers were sent to sponsor banks (aggregator) and banks revert with mandate registration status. The status of each mandate was updated in excel against each customer. If mandates are rejected then were resend to aggregators for re – registration. Basis URN each customer is identified for amount of the loan.

b. Debit Transaction – Registered mandates transaction will start as per the EMI cycle. The list of customers for each EMI cycle are manually listed and shared with aggregators for hitting the transaction. Rejected transactions are re – sent with the consent of customers.

This process was manually handled by users until customer’s loan journey is completed.

New Process – The mandates are handled through systems until customer journey is completed. Physical mandates are updated in the MMS where list of customers from LMS would be collated and uploaded in MMS. Below are the steps followed:

a. Mandate Registration – Mandates from different LMS are uploaded in the MMS and merged registration files are downloaded and are shared directly with aggregators. Once registration status is received the file is uploaded along with the status of each mandate. Then file is downloaded according to the LMS and updated in LMS against each customer. Registered mandates EMI cycle will start from there onwards until completion of the journey.

b. Debit Transaction – Registered mandates list would receive from aggregators on each EMI cycle and same would be uploaded in MMS as per LMS. Merged file of all customers for particular cycle would be sent to respective aggregators for transacting the EMI amount. The status of the each transaction is again downloaded from MMS and updated in respective LMS.

Learnings:

In Mandate Management System maximum work was manual for completing mandate process of each customer. While developing this system ACC got well versed with banking functionality and how the loans in NBFC’s are managed. This process starts post disbursal of loan to a customer and in which way EMI is collected throughout the customer journey.

MMS has reduced the manual work to complete the process from mandate registration to transactions of each EMI cycle until loan is closed / terminated.

Case Study - Profectus Capital - Loan Origination System and SAP S4 HANA

Profectus Capital Private Limited is a start-up Non-Banking Financial Company (NBFC) regulated by Reserve Bank of India (RBI).Profectus Capital aims to be a partner in progress for Small and Medium Businesses and seeks to providing Innovative and customised solutions.

Profectus Capital chosen SAP for their core application requirement. ACC have been working with Profectus Capital for past six months and evangelizing the AWS platform for various workloads, so far we have migrated their lending system to AWS . The end objective is to run all the core operations in the cloud.

Why Amazon Web Services :

following products from AWS as part of its infrastructure:

Amazon EC2 Windows instances—To run the portal, main web site, and business intelligence tools

Elastic IP Addresses for Amazon EC2—To bind to domain names, and start and stop instances on demand

Amazon EBS—Used for data storage, for starting and stopping instances, and for having data always

available

Amazon VPC—Used for a production network.

Elastic Load Balancing—Used for the main web site, to load balance across multiple instances

The Benefit

Significant cost savings and faster time to deployment.

Partnerships