AXIS FINANCE LIMITED

1.Name of the Customer: Axis Finance Limited (AFL)

Axis Finance Limited (AFL), is one of India’s fastest-growing non-banking financial companies (NBFCs) offering tailored financial solutions to a wide range of customers under wholesale, retail, and emerging markets verticals.

2.Challenges Faced by the Customer:

- Currently, AFL employees spend a lot of time reaching out to HR for information related to company policies, leave entitlements (such as maternity or paternity leave), etc. This often leads to delays in receiving responses from HR.

- Visitors and existing customers who have taken a loan with AFL must contact their relationship manager by phone or visit the AFL office to obtain loan details. However, relationship managers are frequently busy, and visiting the office can be time-consuming.

3.Why AWS and Why ACC?

AWS GenAI provides a powerful and flexible platform for developing and deploying AI and ML applications. With its comprehensive set of tools, scalable infrastructure, seamless integration with other AWS services, and strong security measures, it is a robust choice for organizations looking to harness the power of artificial intelligence. Whether you’re building sophisticated models or integrating AI into existing applications, AWS GenAI can help you achieve your goals efficiently and effectively.

ACC had several successful GenAI projects from the Banking and Financial Services sector under its belt.

4.Solution Provided by ACC:

ACC built a ChatBot for AFL, to improve user satisfaction for visitors, customers and employees, with a focus on optimizing information retrieval processes and ensuring real-time access to essential data.

We have used the Cohere model from AWS Bedrock for Retrieval-Augmented Generation (RAG) and stored vector data in an RDS Postgres database, which supported storing vector embeddings. For the ChatBot (Question Answering) feature, we have utilized the Claude Sonnet 3 LLM model from AWS Bedrock.

- The Employee ChatBot is engineered to offer comprehensive details regarding Axis Finance, information about its processes, policies, Employee portal, HRMS portal, and the AFLex training module.

- Employees can interact with the ChatBot to obtain insights into the operational procedures, company policies, access the Employee portal for internal resources, navigate the HRMS portal for human resource-related functions, and explore the AFLex training module for educational purposes.

- The Customer ChatBot offers information about Axis Finance from the AFL website and presents all available services through the current Structured Whats-app to existing customers. The data sources for this functionality includes the AFL website and the databank of existing responses of the customers from past interactions. They can obtain information related to the loan details, download documents, payment. Customer can also use WhatsApp to have a conversation with the ChatBot.

- The Visitor ChatBot provides visitors with information about Axis Finance and assists in retrieving specific details currently available on the AFL website. It utilizes website data as the source for obtaining information related to Track your application, apply for a loan, find a branch near me, calculate EMI, share your feedback,

5.AWS Services used:

- Amazon Bedrock- Claude Sonnet 3

- Amazon VPC (Virtual Private Cloud)

- AWS Transit Gateway

- AWS Data Sync

- Gateway Load Balancer

- AWS Security Hub

- AWS Config

- Amazon CloudWatch

- Amazon S3 Standard

- Amazon Route 53

- AWS CloudTrail

- AWS Key Management Service

- Amazon EC2

6.Results and Benefits:

- The Customer ChatBot provides round-the-clock support, allowing customers to get answers and assistance at any time, even outside regular banking hours.

- It offers immediate responses to customer queries, reducing wait times and improving overall customer satisfaction

- By automating routine inquiries and tasks, chatbots reduces the need for a large customer service team, leading to cost savings on staffing and training.

- This Chatbot has automated repetitive tasks such as checking account balances, transferring funds, or processing loan applications, freeing up human agents for more complex issues.

- Automated responses reduce the risk of human error in handling routine transactions and inquiries.

- Thus, implementing a chatbot in the AFL environment delivers numerous benefits, including enhanced customer service, cost efficiency, and improved operational efficiency. By automating routine tasks and providing 24/7 support, chatbots not only improve customer satisfaction but also enable AFL to optimize its resources and streamline their operations.

7.Metrics for Success:

- Website’s information access will be more streamlined and user-friendly, providing customers and employees with an enhanced experience.

- Employees will experience improved efficiency as they gain quick and convenient access to the information they need, reducing manual search efforts.

- The integration of AI assistance will significantly decrease the chances of errors in information retrieval and dissemination.

- The implementation of this generative AI solution- ChatBot should transform the way information is accessed and shared, creating a more efficient and dynamic environment for all stakeholders.

8.Lessons Learnt:

- Thoroughly understand and map out the common questions and issues that customers have. A chatbot should address the most frequent and significant customer needs to be effective.

- Regularly gather and analyze user feedback to refine and enhance the chatbot’s performance and functionality.

- Maintain consistency in the information provided by the chatbot and human agents to avoid confusion and provide a coherent customer experience.

9.Start Date of the Engagement: 1st April 2024

10.End Date of the Engagement: 31st July 2024

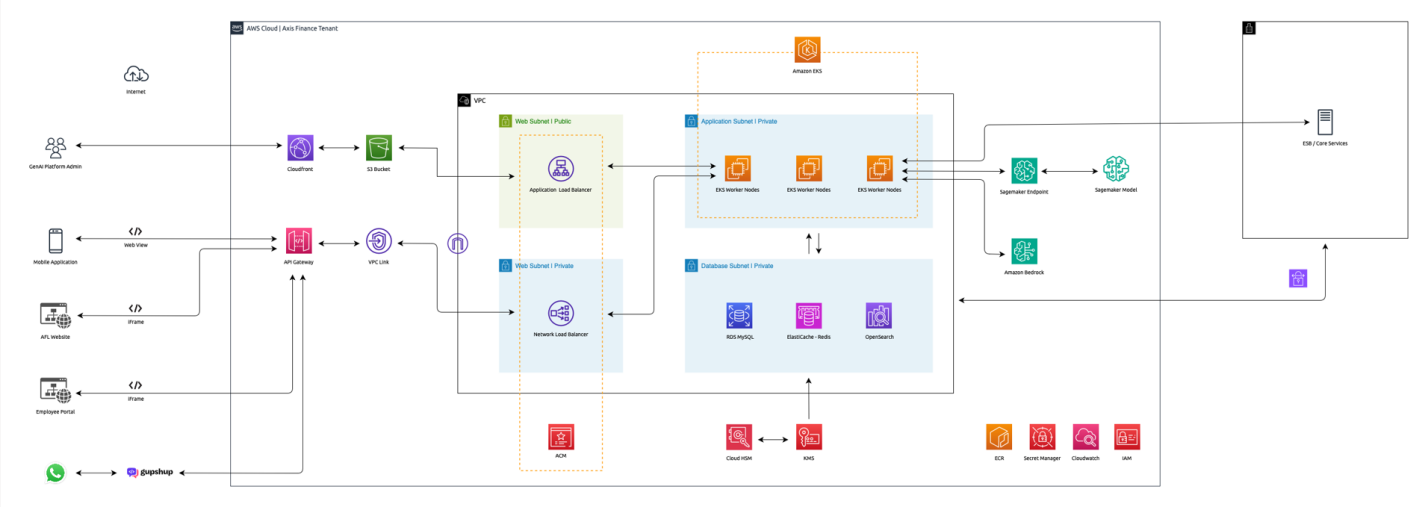

11.Architecture Diagram:

About ACC:

ACC is an AWS Advance Partner with AWS Mobility Competency. Awarded The Best BFSI industry Consulting Partner for the year 2019, ACC has had several successful cloud migration and application development projects to its credit. Our business offerings include Digitalisation, Cloud Services, Product Engineering, Big Data & Analytics and Cloud Security. ACC has developed several products to its credit. These include Ottohm – Enterprise Video and OTT Platform, Atlas API – API Management and Development Platform, Atlas CLM – Cloud Life Cycle Management, Atlas HCM – HR Digital Onboarding and Employee Management, Atlas ITSM – Vendor Onboarding and Service Management and Smart Contracts – Contract Automation and Management.